History of Silver Prices

Let's look at the history of silver prices during the last century. Significant economic and geopolitical developments impacted the course of silver prices over the twentieth century.

Early twentieth century (1900-1930s)

Silver was still linked to the monetary system at the turn of the century, with several countries using the silver standard alongside gold. However, silver's fall as a monetary metal began in the late nineteenth century. In 1873, the United States abandoned the silver standard, and other countries quickly followed suit. This change had a significant impact on silver prices.

Silver prices were volatile in the early twentieth century due to a variety of factors, including World War I, the Spanish Flu pandemic, and the Great Depression. The economic crisis reduced industrial demand for silver, which contributed to price declines.

Mid-twentieth century (1940s-1970s):

The global economy gradually recovered following World War II. Silver demand grew due to rising industrialization and technological breakthroughs. Furthermore, the use of silver in photography and numerous industrial uses increased its value.

The United States had a silver coin scarcity in the 1960s, causing the Mint to lower the silver content of coinage until silver was fully withdrawn from circulation coins in 1971. This change had a profound impact on silver demand.

Late twentieth century (1980s-1990s)

In the early 1980s, one of the most amazing events in the history of silver prices occurred. The Hunt brothers, Texan billionaires, attempted to corner the silver market, causing prices to skyrocket. However, their method eventually failed, resulting in a sharp drop in silver prices.

Silver prices remained somewhat low in the late 1980s and early 1990s. Economic expansion, inflation rates, and the emergence of new industrial applications for silver all had an impact on the market.

21st Century (2000s-2020s):

The twenty-first century brought renewed interest in silver as an investment, owing in part to its dual status as an industrial metal and a precious metal. With the rise of ETFs (Exchange-Traded Funds), investors were able to obtain exposure to silver prices without actually owning the metal.

Silver's price fluctuated significantly in response to the 2008 financial crisis and following worldwide economic instability. During periods of economic uncertainty, the metal's significance as a safe-haven asset grew more obvious.

Silver prices have been influenced in recent years by factors such as growing industrial demand (especially in electronics and green technology), supply concerns, and inflation fears. The metal is still regarded as a valuable component in a variety of industrial uses and as a hedge against economic volatility.

2020s and Beyond

Predicting future silver prices is difficult as of January 2023 because to the multiple dynamic elements at work. Economic conditions, technical improvements, geopolitical events, and changes in investor emotion all contribute to the silver market's complicated dynamics.

Finally, the story of silver prices during the last century demonstrates the metal's transformation from a monetary standard to a versatile commodity with industrial and investment value. The silver market has been molded by the interaction of economic, technological, and geopolitical variables, and its significance in the global economy is evolving.

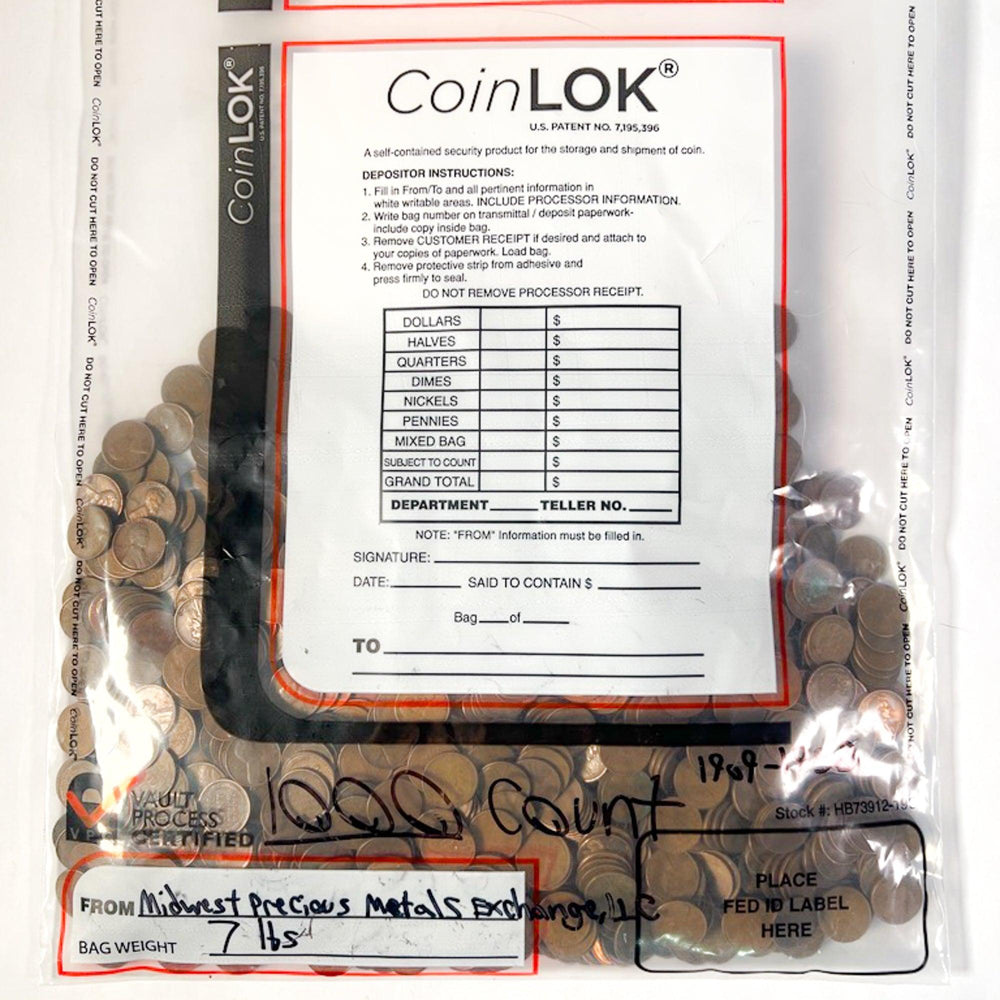

If you're interested in getting started in investing in silver, check out our latest junk silver coins here.