Sales Tax by State

COIN SALES TAX RULES

On June 21, 2018, the United States Supreme Court announced a decision in favor of South Dakota in South Dakota v. Wayfair Inc, where the state argued it was losing out on local sales taxes with more and more consumers shopping online rather than in brick-and-mortar stores.

WHAT DOES THIS MEAN FOR MWPMX CLIENTS?

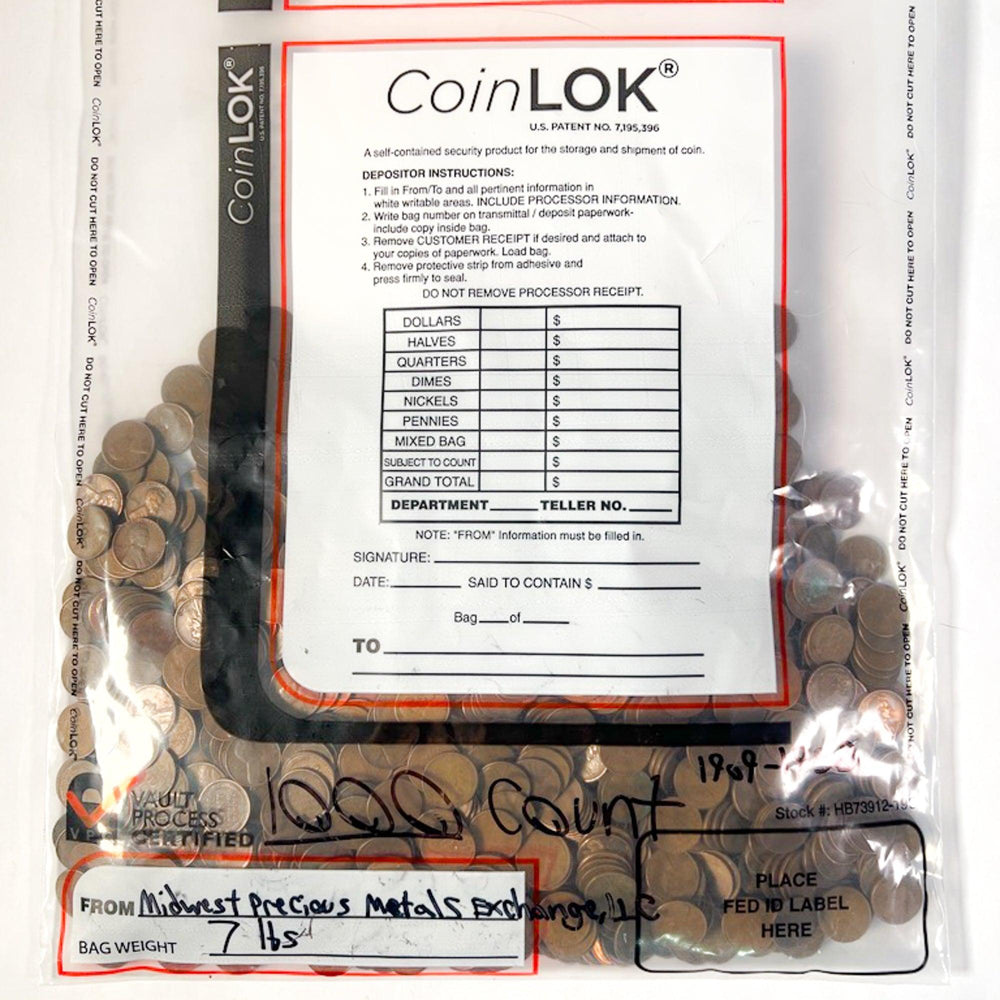

This means that, online retailers such as Midwest Precious Metals Exchange, LLC now have to adapt to the varying state sales tax rules and regulations across the United States. Sales taxes will be calculated and charged based on the address where the order is delivered. These sales tax rules will go into effect across all 50 states beginning April 24, 2019.

EXAMPLES:

- 1.) A client residing in Arkansas places an order for $1,000 worth of silver. They would be charged an additional $65.00 in sales tax in compliance with Arkansas sales tax laws as they apply to bullion.

- 2.) A client residing in Arkansas orders $1,000 of silver to be delivered to a Bullion Depository in Missouri. In this case, the client would only pay $1,000 to the coin dealer in Missouri, and no sales tax, because Missouri has no state sales tax on precious metals.

TAX RULES BY STATE

Clients may refer to the chart below, for a list of sales tax rules by state as they pertain to precious metals. Please note that states periodically change their tax rules, and this list may not be fully up-to-date at all times. There may also be additional sales tax charged based on your city, zipcode, and/or parish as they require.