Gold Spot Price and Investing 101

Gold Price History

Highest Gold Price Ever Achieved:

On August 7, 2020, gold reached an unprecedented peak, hitting a historic high of over $2,074 per ounce. This notable achievement was primarily attributed to a confluence of factors, including the economic uncertainties stemming from the COVID-19 pandemic, low-interest rates, a weakened U.S. dollar, and a surge in demand for safe-haven assets. In a relatively brief span of a few years, another record was established on May 4, 2023, as gold surged to $2,080.72. This surge was instigated by heightened demand triggered by the collapse of Silicon Valley Bank. Wealthy investors swiftly diverted their funds from banks facing potential failure to gold, given the looming threat to substantial amounts of money beyond the FDIC-insured limit of $250,000 per account. Following the collapse of SVB, the downfall of several other prominent banks ensued. Generally, crises tend to drive a surge in demand for safe-haven assets like gold, consequently bolstering prices.

Gold Price Appreciation Over Time:

Over the extended period from 1971 to 2022, gold has exhibited an average annual rate of return of around 7.78%, based on its price performance.

Using All-Time Highs for Timing:

Many investors use the proximity of the current gold price to its all-time high as a timing indicator. When gold nears or surpasses its historical peak, some investors interpret it as a signal to contemplate selling, anticipating a potential correction. Conversely, others view it as an advantageous moment to buy, speculating on the continuation of the upward trend. Breaching significant psychological thresholds, like establishing a new all-time high, introduces the potential for a more extensive and prolonged upward movement in gold prices. Nevertheless, it's crucial to weigh the broader economic and geopolitical context before basing investment decisions solely on historical price highs.

Factors That Influence Gold Prices

Several crucial factors exert a significant influence on determining the price of gold. These factors encompass:

- Economic Conditions: The global economic state, inflation rates, interest rates, and overall financial stability are instrumental in shaping gold prices. In periods of economic uncertainty or inflationary pressure, gold often sees an increase in value as a sought-after safe-haven asset.

- Geopolitical Events: Political instability, conflicts, and trade tensions can profoundly affect gold prices. Investors frequently turn to gold as a safe-haven asset during times of geopolitical turmoil.

- Currency Movements: The value of the U.S. dollar exhibits an inverse relationship with gold prices. A weaker dollar typically results in higher gold prices, as gold becomes more appealing to international investors.

- Central Bank Policies: The actions of central banks in buying and selling gold can impact prices. Significant purchases or sales by central banks can substantially influence the supply and demand dynamics of the gold market.

- Supply and Demand: The equilibrium between gold supply and demand, influenced by factors such as mining production and jewelry consumption, contributes to price fluctuations. Scarcity or excess supply can prompt shifts in prices.

- Investor Sentiment: Market sentiment and speculative behavior can drive short-term price movements. Events, news, and market sentiment can lead to rapid fluctuations in prices.

- Technical Analysis: Traders often employ technical indicators and charts for short-term predictions about gold price movements. These may include moving averages, support and resistance levels, and other technical patterns. The introduction of algorithmic trading patterns based on technical analysis adds complexity to the market.

How Gold Spot Prices are Determined

Gold spot prices are determined through a globally coordinated process overseen by the London Bullion Market Association (LBMA), which establishes standards for gold trading. The LBMA conducts electronic auctions, notably the LBMA Gold Price, twice daily. During these auctions, market participants, including banks, refiners, and institutional investors, submit buy and sell orders until a supply and demand equilibrium is achieved, setting the spot price. International factors, such as currency exchange rates and global economic events, can also influence these prices, making gold a 24/7 traded commodity. Real-time transparency ensures investors have access to accurate spot prices, facilitating well-informed trading decisions.

The determination of gold spot prices involves other major exchanges, with the COMEX (Commodity Exchange, Inc.) playing a prominent role alongside the LBMA. While the LBMA sets global standards and benchmark prices, COMEX, a division of the CME Group, is pivotal in gold futures and options trading. Prices established on COMEX, particularly the most actively traded futures contracts, impact spot prices. These futures contracts offer a forward-looking view of market expectations and influence spot prices due to their significant trading volumes and liquidity. Consequently, the dynamic relationship between LBMA's spot prices and COMEX's futures prices affects the overall price discovery process for gold globally. Other exchanges involved in this process include the Shanghai Gold Exchange, the Tokyo Commodity Exchange, and the Dubai Gold & Commodities Exchange.

How do Gold Futures Affect Gold Spot Prices?

Futures markets, exemplified by entities like COMEX, wield substantial influence over gold spot prices. These markets are pivotal in the price discovery mechanism for gold, offering a benchmark for prevailing spot prices. The existence of arbitrage opportunities between gold futures and spot markets leads to the harmonization of prices as traders exploit disparities. Speculative activities within the futures market hold the potential to shape market sentiment and initiate short-term price fluctuations, impacting both futures and spot prices. Furthermore, stakeholders in the gold industry utilize futures contracts for hedging against price volatility, thereby influencing the supply and demand dynamics in the spot market. The process of rolling over expiring contracts in the futures market can also prompt spot market transactions tied to physical delivery obligations, contributing to shifts in supply and demand dynamics and, consequently, spot prices.

How to Trade the Gold/Silver Ratio

The gold-to-silver ratio signifies the quantity of silver ounces needed to acquire one ounce of gold, providing valuable insights into the relative worth of these metals. A higher ratio historically implies that silver may be undervalued compared to gold, presenting an opportune moment for silver investments. Conversely, a lower ratio might suggest a favorable time for gold investments.

Experienced investors strategically trade between silver and gold based on advantageous market conditions. For instance, if an investor purchased 5 ounces of gold in January 2019 when the gold-to-silver ratio was 82, they might have seized an opportunity to exchange gold for silver in April or May of 2020 at a ratio of 112, resulting in 560 ounces of silver. Later, in September 2020, when the gold-to-silver ratio dropped to 70, trading this ratio would enable the investor to convert their 560 ounces of silver back into 8 ounces of gold.

Assuming the investor initially acquired gold at around $1300/ounce in January 2019, the conversion in September 2020 would yield an average cost per ounce of gold at $812.50. Considering that gold prices exceeded $1900/ounce in September 2020, the investor engaging in this ratio trade during that period would have witnessed remarkable returns of over 133%.

It's important to note that this scenario does not account for factors such as taxes, premiums, or the investor's decision-making in advantageous or disadvantageous trades. In many cases, individual investors trading the gold-to-silver ratio may need to convert to a liquid currency like the US dollar, as direct bartering is often impractical.

Why Gold is a Good Diversifier

Gold remains a perennial favorite among seasoned investors seeking to diversify their portfolios. Unlike many other assets, gold often exhibits independent movement, providing a secure haven during periods of stock market turbulence or currency devaluation.

Diversification is a fundamental aspect of a sound investment strategy, mitigating risk by distributing investments across various asset classes and reducing the potential for severe losses. By incorporating assets like gold, which typically behaves differently from stocks and bonds, you can bolster the stability of your portfolio. Gold's lack of correlation with other assets during market volatility means that when stocks decline, gold prices tend to rise.

In recent years, there has been a growing correlation between stocks and bonds, potentially linked to the "easy money" policies of central banks over the past decade. The prevailing notion for years has been that a mix of bonds and stocks provides diversification, but as these asset classes have started to correlate, the diversification benefits have diminished significantly. In contrast, gold has maintained a lack of correlation with both stocks and bonds, often experiencing increased demand during periods of stock market stress.

Gold and Local Currencies

International exchanges, including COMEX and the LBMA, exert an influence on gold prices in local currencies. The primary impact manifests through exchange rates, where shifts in the global gold price prompt corresponding adjustments in the value of gold in local currencies. A strengthened global gold price typically translates to higher gold prices in local currencies, while a weakened global price may result in lower local prices. Import and export dynamics also contribute, with international price variations fostering trade activities that affect local pricing.

Investor behavior emerges as another influential factor, with global price trends and market news shaping local demand for gold and subsequently impacting local prices. Additionally, arbitrage opportunities may arise when substantial price disparities exist between global and local markets, enabling traders to capitalize on buying low and selling high. This process works to narrow the price gap, aligning global and local prices. These various influences collectively contribute to the intricate relationship between global exchanges and gold prices in local currencies.

A notable illustration of this dynamic occurred in Shanghai in 2023. Domestic production waned after the pandemic, leading to a surge in local demand. Concurrently, the government imposed import restrictions on gold, causing prices to rise as gold became a relatively scarce commodity. Despite the increased prices, arbitrage opportunities were not readily apparent due to government restrictions, creating challenges in achieving price equilibrium with the global gold market.

Gold and the US Dollar

Gold is denominated and traded in the US Dollar, quoted as USD, contributing to the observed correlation between the USD and gold prices. Typically, when the US dollar weakens, gold prices tend to rise, and conversely, when the US dollar strengthens, gold prices often decline. However, it's essential to note that the correlation is not absolute, as various factors influence gold prices. There are instances when the US dollar surges, yet gold experiences robust prices. The FX ticker for gold is XAU/USD, a designation sometimes confused with the Philadelphia Gold and Silver Index. This index comprises thirty gold and silver miners listed on the NASDAQ, with a stock ticker symbol of XAU.

How are FOREX Traders Finding Arbitrage Opportunities in Gold Markets Worldwide?

FOREX traders employ various strategies to identify arbitrage opportunities in gold markets. They take advantage of price discrepancies across different markets and currencies, engaging in cross-currency arbitrage. This involves purchasing gold in a currency where it is cheaper and selling it where the price is higher. Another strategy involves spot-futures arbitrage, where traders capitalize on significant differences between gold's futures and spot prices. Additionally, traders explore intermarket arbitrage, profiting from variations in different gold markets such as the LBMA, COMEX, and local exchanges. While arbitrage can be profitable, traders must be cautious of transaction costs, exchange rate fluctuations, and market liquidity. Acting swiftly is crucial to seize short-lived opportunities before they disappear.

Why is Gold Used as a Store of Wealth?

Gold has served as a wealth store for millennia. Consider a Roman burying an ounce of gold in 100 A.D.; that same amount of gold today could purchase a fine suit with money to spare. This analogy, often employed by gold investors, underscores gold's remarkable ability to retain value over the centuries, a feat unmatched by many assets. This resilience is why gold is deemed a hedge against inflation and why long-term investors pay little heed to short-term fluctuations in gold spot prices.

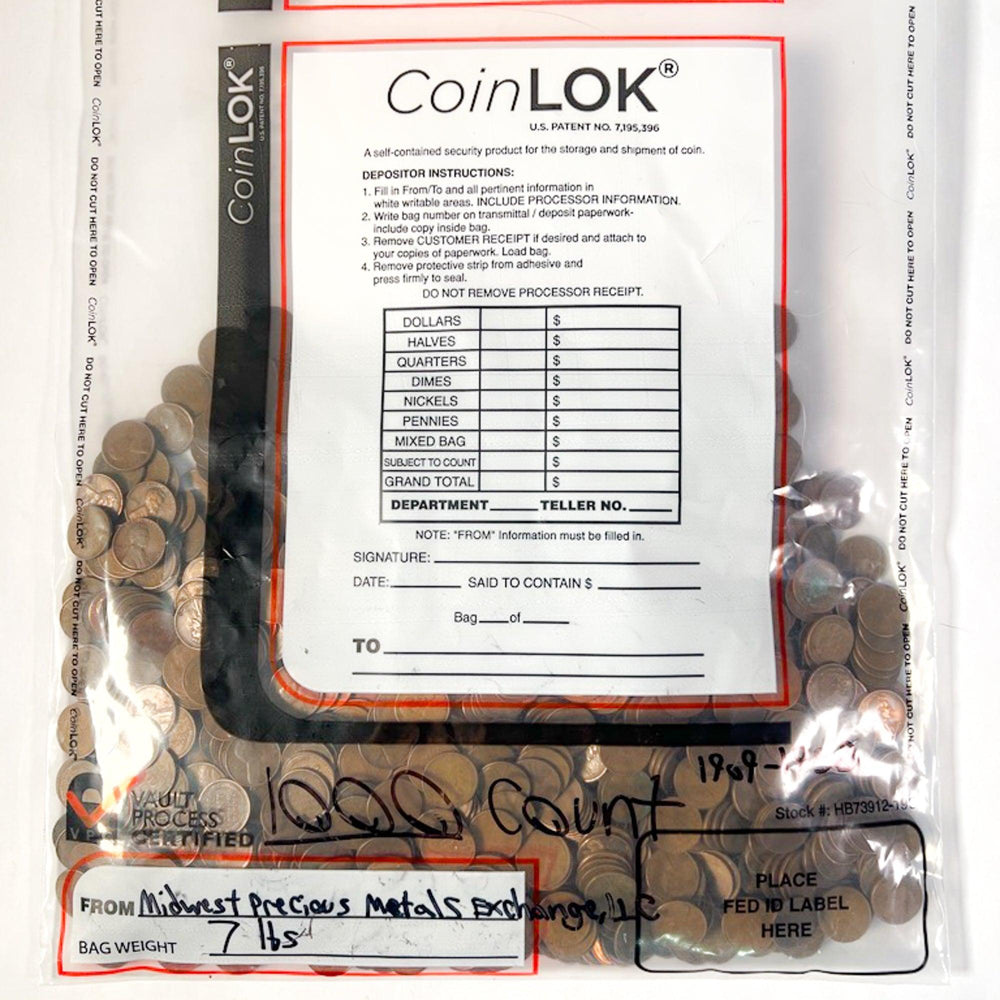

Why You Should Never Attempt to Buy Gold Below Spot Price

As with many industries, there are individuals seeking to exploit others. If an offer appears exceptionally favorable, it's prudent to exercise caution. Someone selling a troy ounce of gold below the spot price is likely dealing in counterfeit gold coins or bars.

While the spot price reflects the metal's value, the premium is crucial for the entire supply chain's sustainability. This premium covers the costs for mines, refiners, mints, and retailers to operate and generate profits. Without a premium, the metal remains in the ground, and a viable market cannot thrive. Therefore, encountering gold listed below the spot price should trigger skepticism.

Check out our current gold selection